Traditional DEXs

DEX Architecture: Smart Contracts, Blockchain, and Consensus

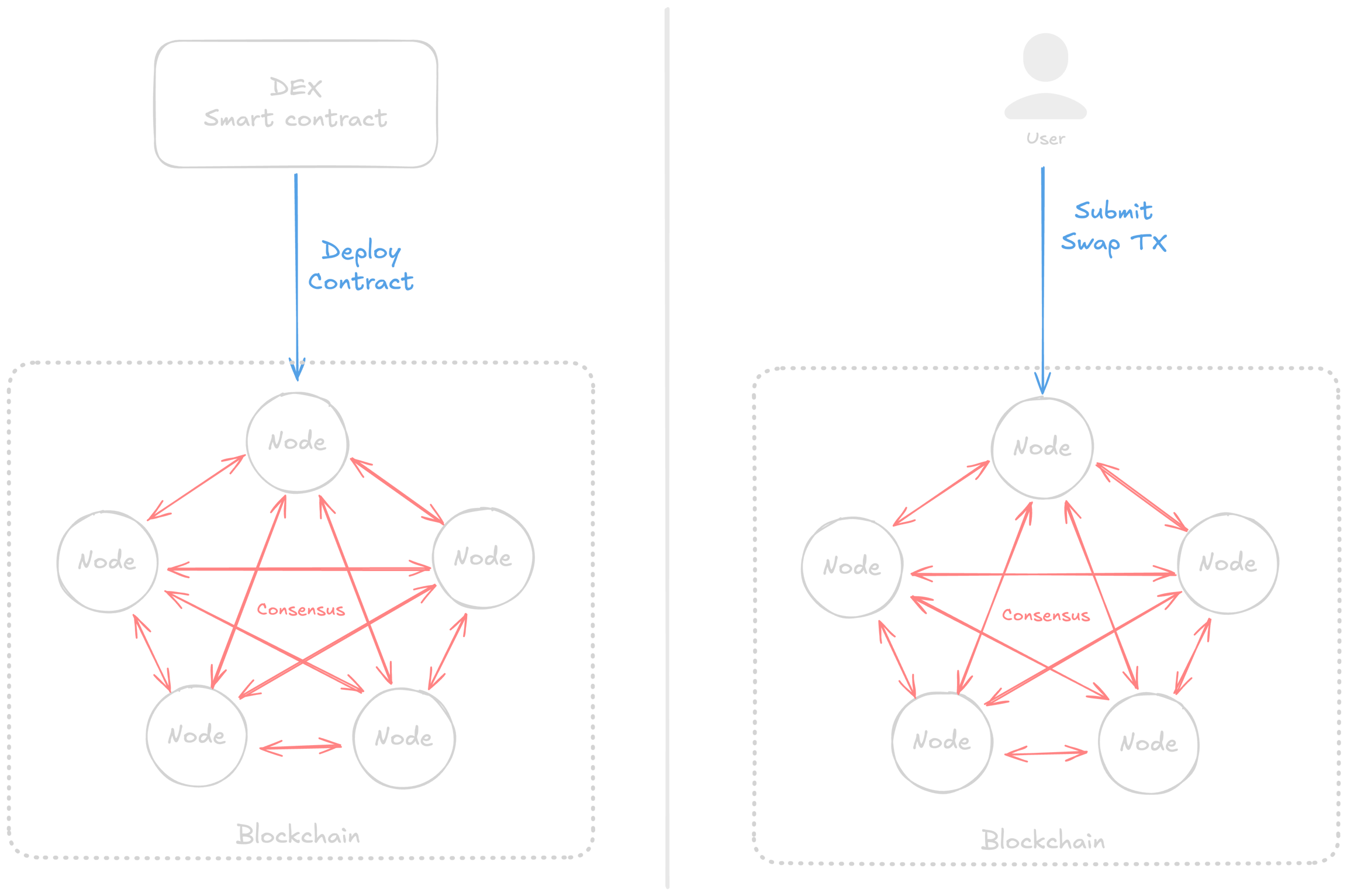

Decentralized exchanges (DEXs) rely on blockchain technology and smart contracts to enable trustless, peer-to-peer trading. Unlike centralized exchanges, where an intermediary processes transactions, DEXs execute trades programmatically through smart contracts that run on a distributed network of blockchain nodes.

Core Components of a DEX

Blockchain as the Settlement and Execution Layer The blockchain serves as the foundational layer for a DEX, recording all transactions, executing smart contract logic, and ensuring immutability. The blockchain operates as a distributed ledger maintained by multiple nodes, preventing centralized control or tampering.

Smart Contracts as the Automated Execution Layer Smart contracts are self-executing code deployed on the blockchain. Once deployed, these contracts become immutable and autonomously execute based on predefined rules. They handle trade execution, liquidity management, and other key DEX functions.

How Smart Contracts Are Executed

When a user initiates a transaction (e.g., placing an order on a DEX), they submit it to the blockchain network, where it is picked up by blockchain nodes.

The smart contract code is executed within a virtual machine (e.g., Ethereum Virtual Machine - EVM). The EVM ensures that all nodes execute the contract code in a deterministic manner, meaning the same input always produces the same output.

Nodes validate the transaction, compute the required state changes, and prepare it for inclusion in a block.

Transaction Sequencing and Consensus

For a DEX to function securely and efficiently, transactions must be ordered correctly and agreed upon by the network. This process involves sequencing and consensus mechanisms.

Transaction Propagation and Sequencing

When a user submits a transaction to the blockchain, it enters the mempool, a waiting area where pending transactions are stored before being confirmed.

Miners or validators select transactions from the mempool, prioritize them based on gas fees

Consensus Mechanism: Ensuring Network Agreement Since blockchains operate as decentralized networks, a consensus protocol is required to ensure all nodes agree on the transaction order and validity.

Finalizing Transactions and State Updates

Once a block is confirmed through consensus, the transactions within it are permanently recorded on the blockchain.

The smart contract state updates accordingly (e.g., user balances are adjusted, liquidity pools are updated).

The transaction is now irreversible and trustlessly settled.

User Interaction with Smart Contracts on a DEX

From a user’s perspective, interacting with a DEX follows these steps:

Connecting a Wallet

Users connect their Web3 wallet (e.g., MetaMask, WalletConnect, RabbyWallet) to the DEX interface.

The wallet does not store funds but manages private keys and signs transactions.

Approving Smart Contracts

Users must approve smart contracts to access their tokens. This ensures that the contract can execute swaps or liquidity transactions on their behalf.

Submitting Transactions

When a trade is placed, the transaction is sent to the blockchain network, where nodes validate and execute the corresponding smart contract logic.

Transaction Confirmation and Settlement

After passing through the consensus process, the trade is recorded on the blockchain, and the user’s balance is updated.

The transaction is final and cannot be reversed, ensuring security and transparency.

Challenges of Traditional DEX Architecture

While DEXs offer self-custody and decentralization, they face limitations:

Scalability & Latency – Since transactions require blockchain validation, network congestion can cause delays and increased gas fees.

Liquidity Fragmentation – Assets are often confined to specific blockchains, making cross-chain trading inefficient.

MEV and Front-Running – Malicious actors can manipulate transaction sequencing for profit.

By understanding these architectural components, it becomes clear why traditional DEXs, while innovative, have struggled to compete with centralized exchanges in terms of efficiency and usability. In the next section, we will explore how Zex redefines this architecture to offer a decentralized exchange that overcomes these limitations while maintaining the benefits of self-custody and transparency.