How CEXs Works

CEX Architecture: Order Books, Matching Engines, and Custodial Control

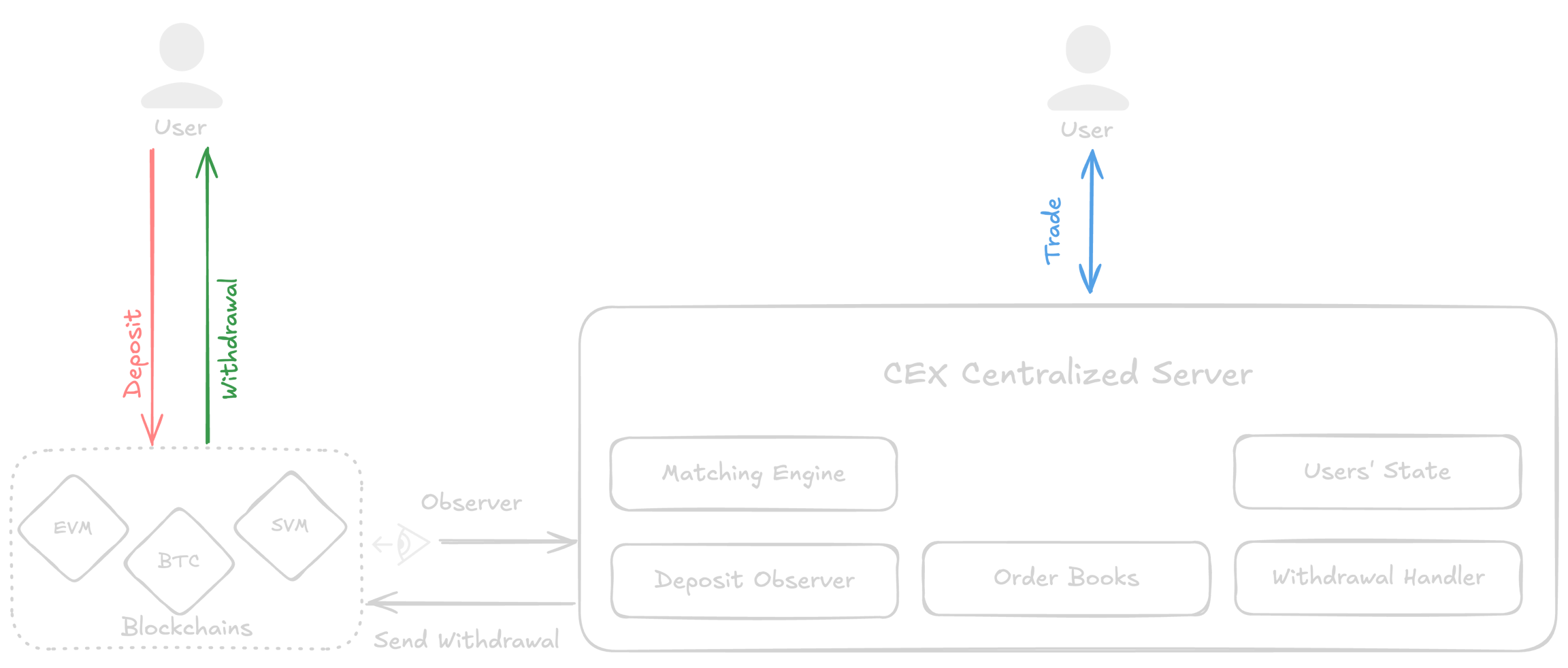

Centralized exchanges (CEXs) are the dominant trading platforms in the cryptocurrency market, offering high-speed trade execution, deep liquidity, and a user-friendly experience. Unlike decentralized exchanges (DEXs), CEXs maintain full control over user funds by managing balances through internal ledgers and executing trades via a centralized matching engine and order book.

Core Components of a Centralized Exchange

Order Book: The Heart of Market Liquidity

An order book is a real-time record of buy and sell orders submitted by traders.

Orders are categorized into:

Limit Orders: Users specify a price at which they want to buy or sell an asset.

Market Orders: Users execute a trade immediately at the best available price.

Stop Orders: Orders that trigger once the asset reaches a predefined price.

The order book ensures price discovery and allows traders to see market depth and liquidity.

Matching Engine: Executing Trades Efficiently

The matching engine is a high-performance system responsible for executing trades by pairing buy and sell orders.

It uses algorithms to:

Match market orders with the best available limit orders.

Maintain the order book by prioritizing orders based on price-time priority (earlier orders at the same price execute first).

Prevent anomalies such as self-trading or invalid transactions.

The matching engine ensures low-latency execution, processing millions of orders per second on high-frequency exchanges.

How CEXs Maintain User Balances

Unlike DEXs, where funds remain in users' wallets, CEXs custody user assets and manage balances through an internal ledger. This process involves:

Deposit & Custody of User Funds

When a user deposits assets, the funds move to the exchange's hot wallet (for active trading) or cold wallet (for long-term storage & security).

The CEX updates the user’s balance on its internal database, allowing them to trade.

Trade Execution and Balance Updates

When an order is filled, the exchange updates the buyer’s and seller’s balances internally, rather than executing transactions on-chain.

This system removes blockchain latency and fees, enabling faster trading.

Full Custodial Control Over User Assets

Since the CEX manages all funds, it has full control over withdrawals, deposits, and security measures.

While this allows for efficient trading, it also introduces risks such as:

Hacks & Security Breaches: If an exchange is compromised, user funds can be stolen.

Operational Risks: Insolvency or mismanagement can lead to loss of assets.

Censorship & Freezing of Accounts: Users rely on the exchange’s policies and can be restricted from accessing funds.