Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Speed: The performance and speed limitations of DEXs make them unsuitable for Scalping or Day trading. Scalping trades happen in a second or less, but, a transaction confirmation for finalising a trade might take several seconds if not minutes, by the end of which there might be price changes.

Scalability: Whereas prominent centralised exchanges process hundreds of thousands of orders per second, blockchains, where decentralised exchanges are deployed, can only manage hundreds of orders each second. As a result, the number of users who could use a decentralised exchange is way smaller and more limited compared to that of centralised exchanges.

Cross-Chain Trading: Decentralised exchanges are limited to the liquidity volumes available on their chosen blockchain which is relatively small due to liquidity fragmentation as a result of ever growing number of blockchains. Centralised exchanges, on the other hand, pool all the liquidity available on all chains together which enables cross-chain trading and makes them much more capital-efficient in comparison.

Capital Efficiency: Decentralised exchanges commonly use automated market makers (AMMs) for trading, but this method is not capital efficient. AMMs require large liquidity pools that often lock up significant capital, particularly in low-volume pairs where returns may not justify the investment. In contrast, centralised exchanges match buyers and sellers through order books, optimizing capital use and providing more flexible liquidity.

Zelullar Exchange is capable of providing the following distinctive features:

Speed

Matching orders in 1 second.

Scalability

Processing 100k orders per second.

Cross-chain Trading

Supporting tokens on EVM chains, Bitcoin, Monero, etc.

Capital Efficiency

Order-driven with no dependency on liquidity pools.

By enabling the features above, Zellular Exchange aims to capture a significant share of the market currently dominated - by over 90% - by centralised exchanges.

As previously discussed, Zellular Exchange (Zex) is designed to bridge the gap between decentralized exchanges (DEXs) and centralized exchanges (CEXs). More specifically, Zex is a decentralized exchange that offers the security and transparency of a DEX while providing the user interface and trading experience of a CEX.

Traditionally, users interacting with centralized exchanges must transfer their funds to wallets, multisigs, or smart contracts controlled by the exchange. The exchange then updates their balance on its internal ledger, allowing them to trade across various markets. However, in this model, the centralized exchange has complete control over users' funds and balances, exposing them to custodial risks.

Zex takes a fundamentally different approach by prioritizing decentralization and user security. Instead of requiring users to entrust their assets to a centralized entity, Zex ensures that users retain full custody of their funds while benefiting from an efficient and high-performance trading environment.

Historically, decentralized exchanges (DEXs) have favored automated market makers (AMMs) over order books due to the impracticality of matching orders directly on the blockchain. This is largely because blockchains have inherent limitations, such as latency and transaction throughput. While AMMs provide an effective solution to these challenges, they come with their own set of drawbacks. As a result, over still occurs on centralized exchanges, where these limitations don't apply.

Zellular Exchange merges the advantages of centralised and decentralised exchanges by offering a permissionless yet efficient trading environment. Leveraging its decentralised matching engine, powered by the , it delivers order-driven trading with high throughput. Hosted on EigenLayer and secured through ETH restaking, it provides a sufficiently decentralised and secure platform.

In the , we will start from the architecture of a traditional DEX and illustrate how Zex redefines its components to create a hybrid exchange model that combines the best of both worlds.

For a deeper understanding of the Zex platform, the provides detailed explanations of its various components. It also illustrates the flow of key user actions such as depositing, withdrawing, and placing orders.

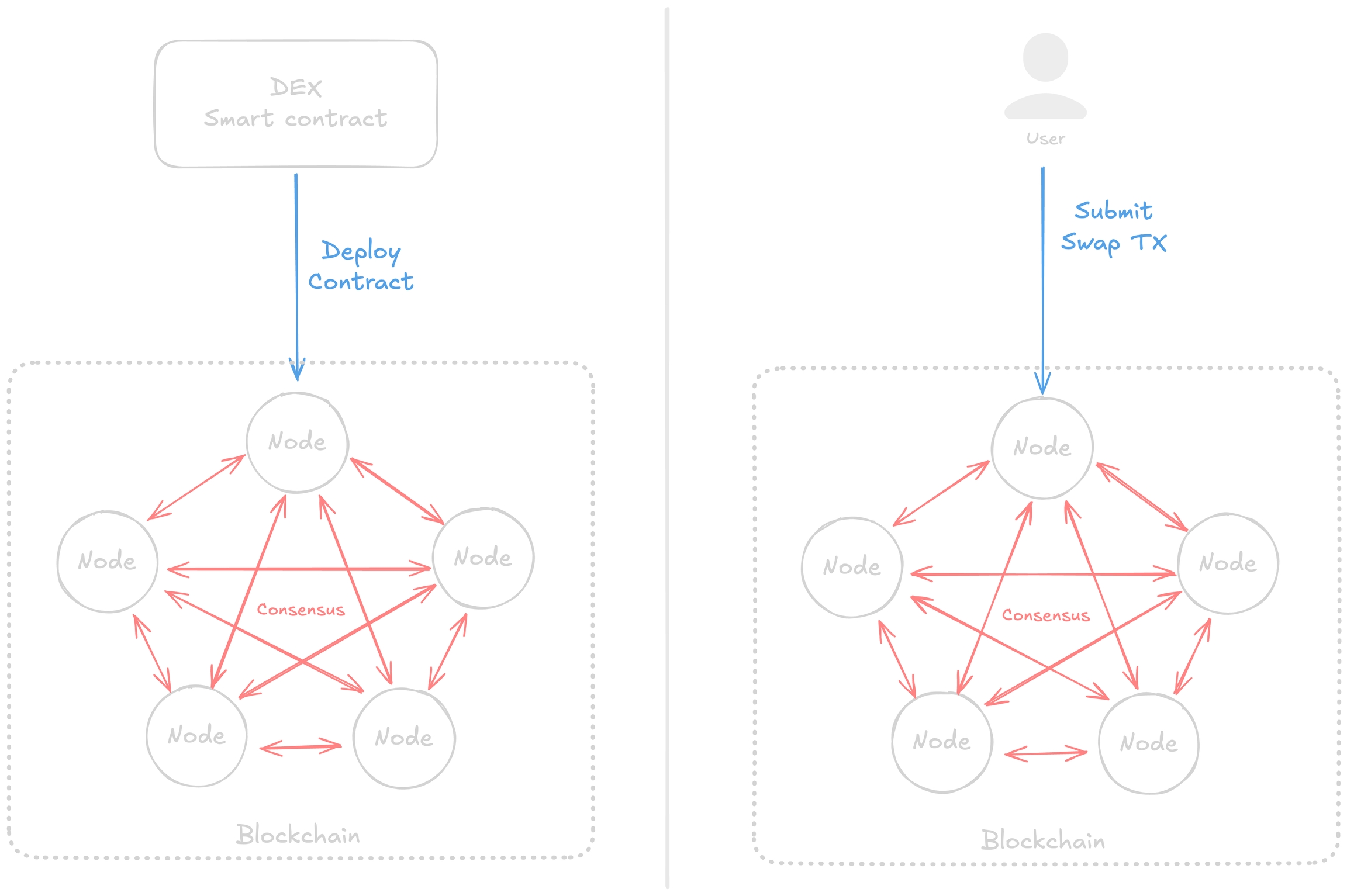

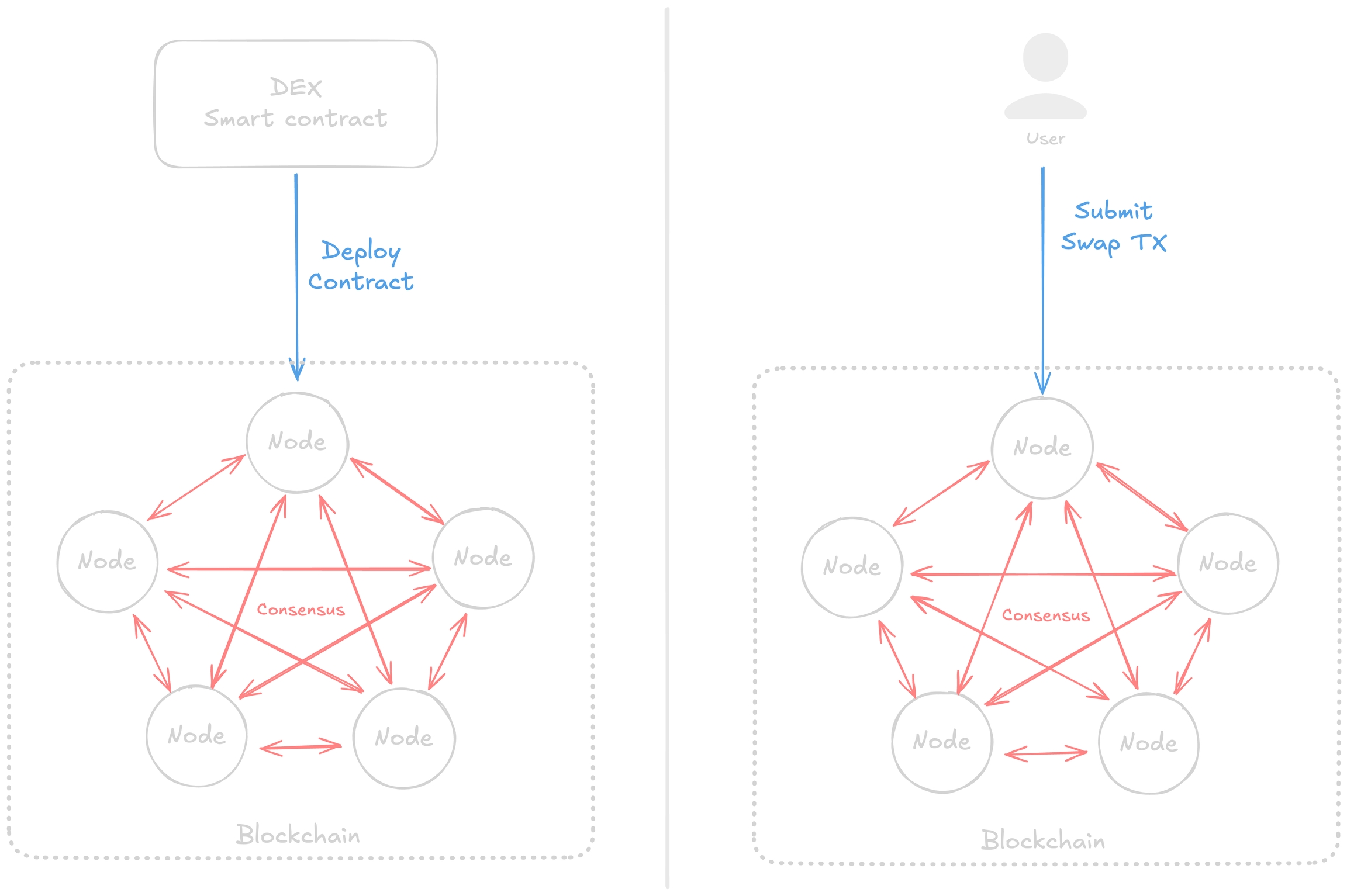

Decentralized exchanges (DEXs) rely on blockchain technology and smart contracts to enable trustless, peer-to-peer trading. Unlike centralized exchanges, where an intermediary processes transactions, DEXs execute trades programmatically through smart contracts that run on a distributed network of blockchain nodes.

Blockchain as the Settlement and Execution Layer The blockchain serves as the foundational layer for a DEX, recording all transactions, executing smart contract logic, and ensuring immutability. The blockchain operates as a distributed ledger maintained by multiple nodes, preventing centralized control or tampering.

Smart Contracts as the Automated Execution Layer Smart contracts are self-executing code deployed on the blockchain. Once deployed, these contracts become immutable and autonomously execute based on predefined rules. They handle trade execution, liquidity management, and other key DEX functions.

How Smart Contracts Are Executed

When a user initiates a transaction (e.g., placing an order on a DEX), they submit it to the blockchain network, where it is picked up by blockchain nodes.

The smart contract code is executed within a virtual machine (e.g., Ethereum Virtual Machine - EVM). The EVM ensures that all nodes execute the contract code in a deterministic manner, meaning the same input always produces the same output.

Nodes validate the transaction, compute the required state changes, and prepare it for inclusion in a block.

For a DEX to function securely and efficiently, transactions must be ordered correctly and agreed upon by the network. This process involves sequencing and consensus mechanisms.

Transaction Propagation and Sequencing

When a user submits a transaction to the blockchain, it enters the mempool, a waiting area where pending transactions are stored before being confirmed.

Miners or validators select transactions from the mempool, prioritize them based on gas fees

Consensus Mechanism: Ensuring Network Agreement Since blockchains operate as decentralized networks, a consensus protocol is required to ensure all nodes agree on the transaction order and validity.

Finalizing Transactions and State Updates

Once a block is confirmed through consensus, the transactions within it are permanently recorded on the blockchain.

The smart contract state updates accordingly (e.g., user balances are adjusted, liquidity pools are updated).

The transaction is now irreversible and trustlessly settled.

From a user’s perspective, interacting with a DEX follows these steps:

Connecting a Wallet

Users connect their Web3 wallet (e.g., MetaMask, WalletConnect, RabbyWallet) to the DEX interface.

The wallet does not store funds but manages private keys and signs transactions.

Approving Smart Contracts

Users must approve smart contracts to access their tokens. This ensures that the contract can execute swaps or liquidity transactions on their behalf.

Submitting Transactions

When a trade is placed, the transaction is sent to the blockchain network, where nodes validate and execute the corresponding smart contract logic.

Transaction Confirmation and Settlement

After passing through the consensus process, the trade is recorded on the blockchain, and the user’s balance is updated.

The transaction is final and cannot be reversed, ensuring security and transparency.

Challenges of Traditional DEX Architecture

While DEXs offer self-custody and decentralization, they face limitations:

Scalability & Latency – Since transactions require blockchain validation, network congestion can cause delays and increased gas fees.

Liquidity Fragmentation – Assets are often confined to specific blockchains, making cross-chain trading inefficient.

MEV and Front-Running – Malicious actors can manipulate transaction sequencing for profit.

By understanding these architectural components, it becomes clear why traditional DEXs, while innovative, have struggled to compete with centralized exchanges in terms of efficiency and usability. In the next section, we will explore how Zex redefines this architecture to offer a decentralized exchange that overcomes these limitations while maintaining the benefits of self-custody and transparency.

When we speak of verification, we may refer to:

Verifying sequenced transactions received from the Master Sequencer to ensure proper ordering.

Verifying transactions received from users (e.g., open orders) before execution in Zex AVS.

In addition to sequence verification, we need a mechanism to verify and validate transactions to ensure they originate from legitimate sources. This verification process occurs within Zex AVS before execution.

To fully understand this verification flow, we must first elaborate on the internal structure of Zex AVS. In the following pages, we will:

Explain how a Centralized Exchange (CEX) operates, focusing on its order book, matching engine, and custodial control over user funds.

Illustrate how Zex enhances and improves the conventional CEX architecture, integrating decentralization while maintaining efficiency and high performance.

Once Zellular Clients receive a batch of sequenced transactions, verification is performed using a . This cryptographic method ensures that all transactions are correctly included in the sequence and have not been altered.

For a deeper understanding of this verification process, please refer to the .

These topics will be covered in detail in the .

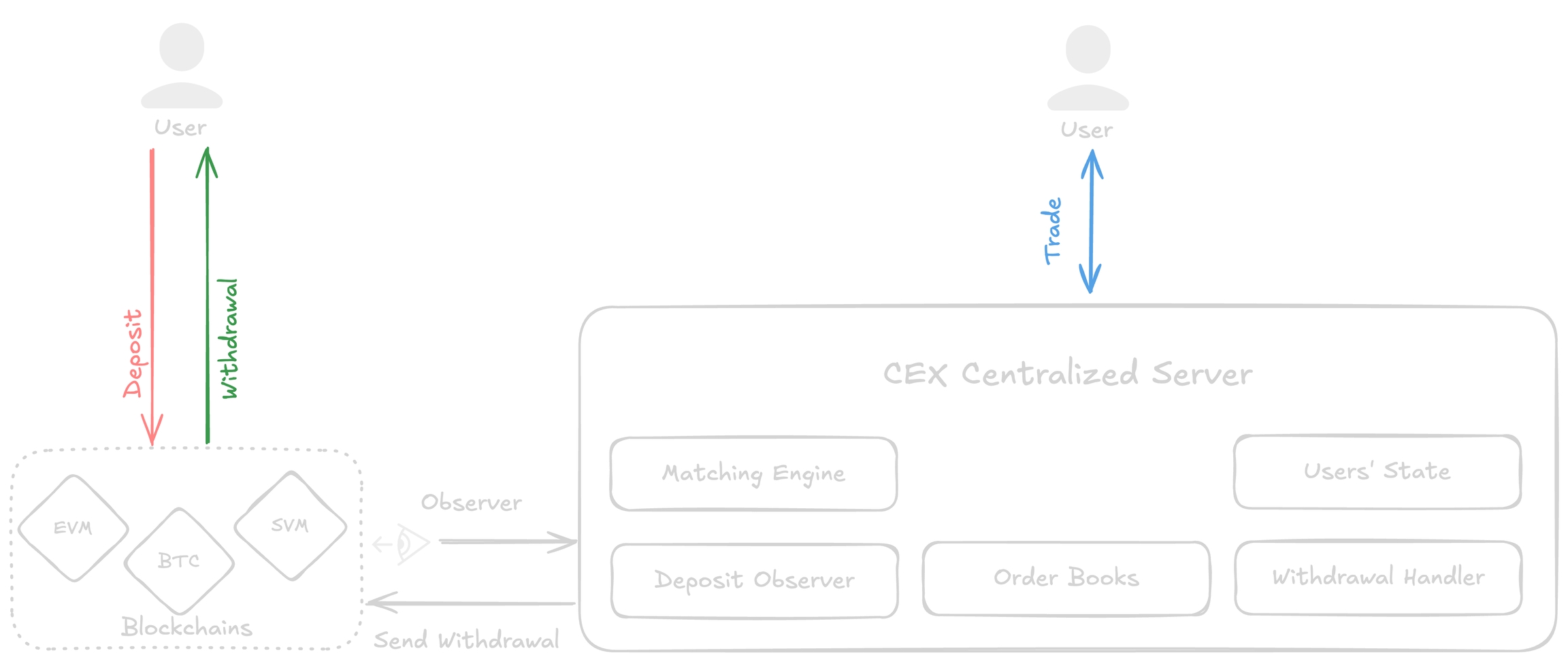

Centralized exchanges (CEXs) are the dominant trading platforms in the cryptocurrency market, offering high-speed trade execution, deep liquidity, and a user-friendly experience. Unlike decentralized exchanges (DEXs), CEXs maintain full control over user funds by managing balances through internal ledgers and executing trades via a centralized matching engine and order book.

Order Book: The Heart of Market Liquidity

An order book is a real-time record of buy and sell orders submitted by traders.

Orders are categorized into:

Limit Orders: Users specify a price at which they want to buy or sell an asset.

Market Orders: Users execute a trade immediately at the best available price.

Stop Orders: Orders that trigger once the asset reaches a predefined price.

The order book ensures price discovery and allows traders to see market depth and liquidity.

Matching Engine: Executing Trades Efficiently

The matching engine is a high-performance system responsible for executing trades by pairing buy and sell orders.

It uses algorithms to:

Match market orders with the best available limit orders.

Maintain the order book by prioritizing orders based on price-time priority (earlier orders at the same price execute first).

Prevent anomalies such as self-trading or invalid transactions.

The matching engine ensures low-latency execution, processing millions of orders per second on high-frequency exchanges.

Unlike DEXs, where funds remain in users' wallets, CEXs custody user assets and manage balances through an internal ledger. This process involves:

Deposit & Custody of User Funds

When a user deposits assets, the funds move to the exchange's hot wallet (for active trading) or cold wallet (for long-term storage & security).

The CEX updates the user’s balance on its internal database, allowing them to trade.

Trade Execution and Balance Updates

When an order is filled, the exchange updates the buyer’s and seller’s balances internally, rather than executing transactions on-chain.

This system removes blockchain latency and fees, enabling faster trading.

Full Custodial Control Over User Assets

Since the CEX manages all funds, it has full control over withdrawals, deposits, and security measures.

While this allows for efficient trading, it also introduces risks such as:

Hacks & Security Breaches: If an exchange is compromised, user funds can be stolen.

Operational Risks: Insolvency or mismanagement can lead to loss of assets.

Censorship & Freezing of Accounts: Users rely on the exchange’s policies and can be restricted from accessing funds.

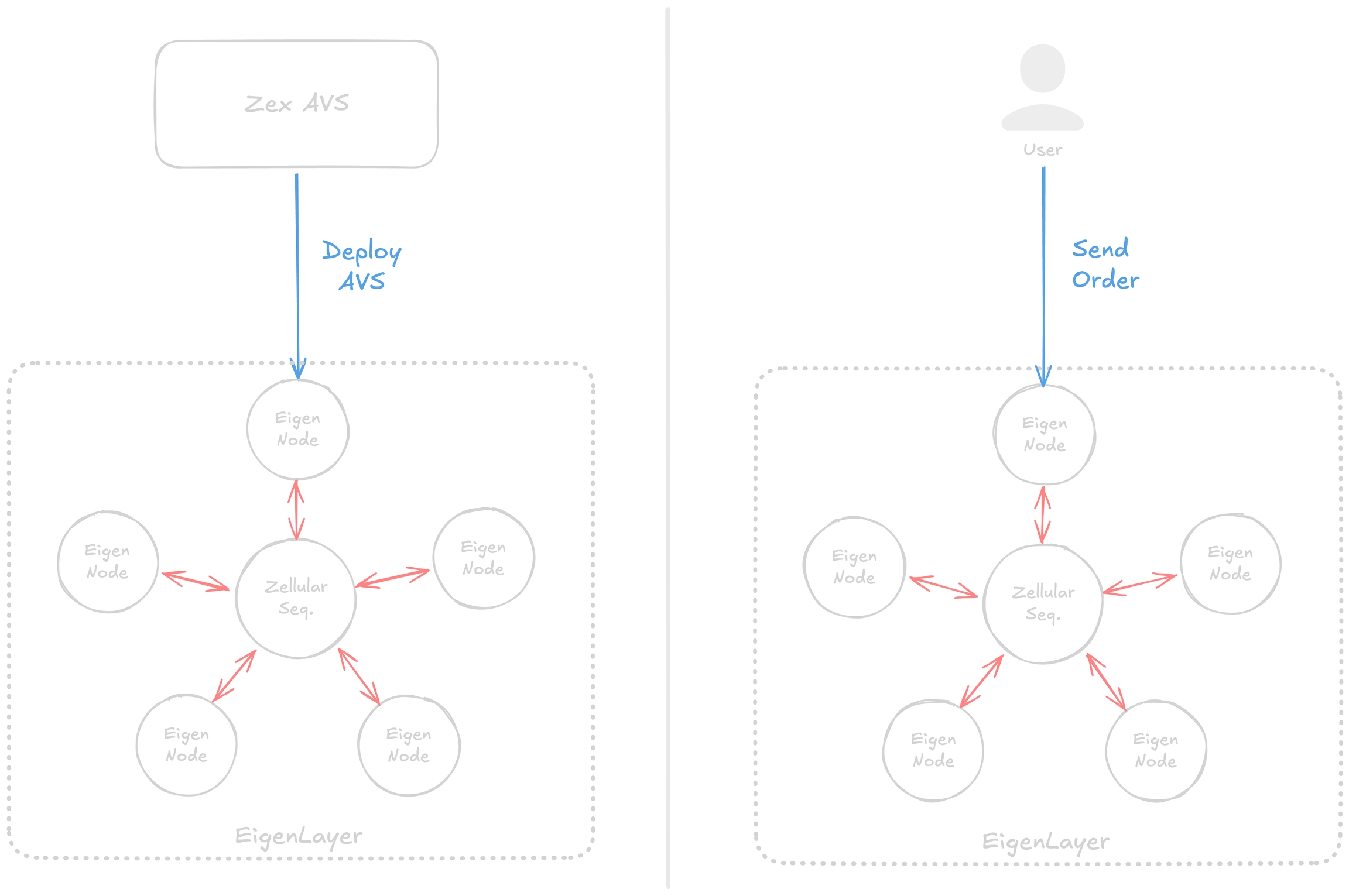

EigenLayer Nodes as the Execution & Security Layer

Instead of using a traditional blockchain, Zex operates on EigenLayer, a decentralized network where staked Ethereum (ETH) validators secure execution through restaking.

These nodes validate transactions, ensure security, and maintain data availability, removing reliance on standard blockchain consensus mechanisms.

Restaking allows validators to secure multiple protocols simultaneously, increasing capital efficiency while preserving decentralization.

AVS (Autonomous Verifiable Service) instead of the Smart Contract

Instead of conventional on-chain smart contracts, Zex develops an AVS to process transactions and automate trading logic. We will delve deeper into this AVS to explain how we offer the user interface of a centralized exchange.

AVS enables off-chain computation with cryptographic verification, ensuring security and trustlessness while significantly improving execution speed. We refer to this as Zex being "sufficiently decentralized."

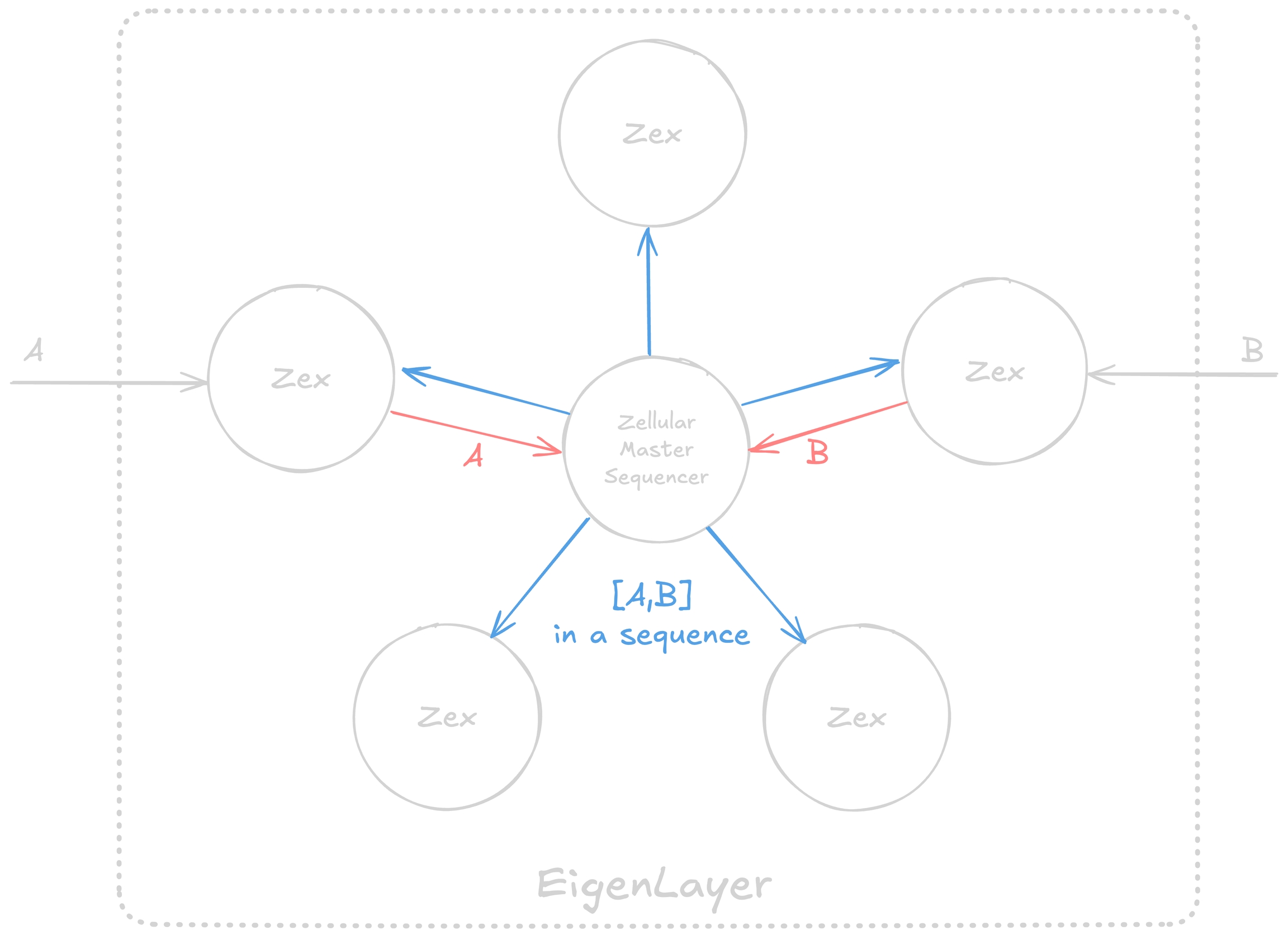

Zellular Sequencer: Coordinating Transactions and Finality

Zex leverages the Zellular Sequencer to provide deterministic ordering of transactions and bring sub-second finality for transactions.

The sequencer aggregates and orders transactions before execution in EigenLayer nodes, ensuring syncronization while maintaining decentralization.

Unlike blockchain-based mempools, the sequencer optimizes sequencing off-chain.

Connecting a Wallet

Users connect their Web3 wallet (MetaMask, WalletConnect, RabbyWallet) to the Zex interface.

Unlike traditional DEXs, no blockchain fee is required, as execution happens on EigenLayer.

Trade Execution

When a user places an order, the transaction is sent to the Zellular Sequencer, which determines the order of execution.

The Zex AVS gets the ordered transaction batch from the sequencer and using its matching engine component to execute the transactions.

Transactions are executed, finalized and the user’s balance is updated in a decentralized and immutable manner.

To address this issue, we first introduce the concept of a Replicated State Machine (RSM).

A Replicated State Machine (RSM) is a distributed computing model that ensures multiple nodes in a network execute the same sequence of transactions in the same order, thereby maintaining a consistent system state. In a decentralized environment like Zex AVS, where different nodes process transactions independently, an RSM guarantees that all nodes remain synchronized regardless of execution order discrepancies.

To achieve this, RSMs rely on deterministic execution and consistent transaction ordering. Each node starts from the same initial state and processes an identical sequence of transactions in a predefined order. This order is enforced by a leader-based or consensus-driven mechanism, such as Byzantine Fault Tolerant (BFT) consensus or a decentralized sequencer like the Zellular Sequencer in Zex. By doing so, the network prevents state divergence and ensures that every node reflects the correct, agreed-upon state at any given time.

In Zex AVS, the combination of Replicated State Machine (RSM) principles and the Zellular Sequencer ensures seamless transaction synchronization, eliminating the risk of inconsistent states across nodes while maintaining decentralization and high throughput.

Zex AVS includes an integrated Zellular Sequencer client that processes unsequenced transactions. When a transaction is received, Zex AVS sends it to this client, which then forwards all transactions to an EigenLayer node hosting the Zellular Master Sequencer. The Master Sequencer orders the transactions in a consistent and deterministic manner, ensuring that all network participants execute them in the same order. Once sequenced, the transactions are sent back to the Zellular Sequencer client within Zex AVS, ensuring proper execution across all nodes.

This structured approach guarantees transaction finality while preventing inconsistencies, allowing Zex AVS to function as a high-performance, decentralized exchange system.

Zex redefines the traditional decentralized exchange (DEX) model by replacing the conventional blockchain and smart contract architecture with and . An AVS on EigenLayer is a decentralized service built on Ethereum that leverages custom validation mechanisms for off-chain operations, secured through ETH restaking. Unlike legacy DEXs that rely on blockchain consensus, Zex employs the to establish ordering and finality among EigenLayer nodes, creating a more efficient, scalable, and decentralized trading environment.

Zellular Sequencer is a decentralized sequencer that enables the development of high-throughput dApps. The sequencer is secured through EigenLayer infrastructure. For those interested in technical aspects of this sequencer, more details can be found in the .

Zex AVS is designed to operate in a decentralized manner. This means that multiple nodes must execute transactions, update the system state, and maintain consistency across the network. However, consider a scenario where one node executes Transaction followed by Transaction , while another node executes Transaction first. In such cases, the Zex network could become unsynchronized, leading to inconsistencies in the system state.

Every transaction originates from one of two sources:

User transactions typically involve activities such as user registration, opening and closing orders, and sending withdrawal requests. For these transactions, users issue signatures, usually via their wallets. The ZexCora module is responsible for validating these signatures and verifying the source of the transaction to ensure it originates from an authorized user.

When a user makes a deposit to the Zex platform, the system needs to acknowledge the on-chain transfer and update the user’s balance accordingly. To handle this process in a decentralized manner, Zex employs multiple instances of observers, collectively referred to as ZexPorta. These observers issue a threshold signature using the FROST (Flexible Round-Optimized Schnorr Threshold Signatures) algorithm. This threshold signature is then verified by the FROST Verifier within ZexCora, ensuring that the deposit is valid and securely processed.

In the , we explained how sequenced transactions (TXs) are verified using BLS signatures. Now, we focus on verifying transactions and validating their sources to ensure authenticity and security.

The ZexPorta module plays a crucial role in facilitating decentralized deposit management, and we will explore its functionalities in detail in its in the .

The Autonomous Verifiable Service (AVS) of Zex is designed to function similarly to a centralized exchange (CEX), incorporating components such as a matching engine and order books. However, key modifications have been made to enhance decentralization and security:

Integration of the Zellular Sequencer Component: This addition ensures the proper sequencing of transactions across the network.

Inclusion of the FROST Verifier Component: This component facilitates secure and efficient threshold signatures.

Removal of On-Chain Interaction Modules: Components responsible for on-chain interactions, such as the deposit handler and withdrawal manager, have been omitted to streamline operations.

The algorithm is designed for issuing Threshold Signature Schemes (TSS) in a distributed manner. It ensures secure, efficient, and decentralized signing processes, which are crucial for the Zex AVS. To implement FROST, we use , a Python library that simplifies and optimizes the process of generating threshold signatures. For more details about FROST and its applications, you can refer to the .

The Zellular Sequencer Component is a core part of the Zex AVS architecture. It is responsible for sending unsequenced transactions to the Master Sequencer, which orders them in a consistent and deterministic manner. Once sequenced, the ordered transactions are sent back to the Zellular Sequencer Component, which passes them to the matching engine for execution. This process ensures synchronization across the network and preserves the decentralized nature of the exchange. More details about the role of the Zellular Sequencer can be found in the of the documentation.

On-chain interactions are crucial for ensuring a secure and sufficiently decentralized exchange. To achieve this, we have developed a module called ZexProta to handle all on-chain interactions effectively. Meanwhile, the remaining off-chain functionalities of our platform are managed by a module named ZexCora, which, as mentioned, operates similarly to a centralized exchange (CEX). Before diving into the specifics of ZexProta, it is important to first understand the high-level architecture of PyFrost. We will explore this topic in greater detail in the .

Zex’s Smart Contracts form the first core module of our system. Although relatively straightforward in design, these contracts are essential for user interaction, serving as the primary gateway for secure deposits and withdrawals. By leveraging these contracts, Zex ensures that users can seamlessly move assets into and out of the platform while maintaining robust fund management and security.

The Vault securely holds user funds and processes withdrawals. Upon verifying signatures from the D/W module, it transfers tokens to the designated user. Additionally, the Vault features a specialized permission allowing Zex to withdraw funds under emergency circumstances, ensuring both flexibility and safeguarding of assets.

For each user and on every supported EVM chain, Zex deploys a User Deposit Contract to receive NFTs, ERC20 tokens, and native assets. The Deposit component of the D/W module continuously observes these chains, retrieving deposits data, issuing signature that updating user balances in Zex Core upon validation. Once confirmed, the deposited assets move to the Vault. Notably, the address of each User Deposit Contract remains consistent across all chains, automatically deploying the first time a deposit is detected.

The User Deposit Factory is responsible for deploying each User Deposit Contract at a predetermined address based on a unique user ID. This ensures that every user’s deposit address remains uniform across multiple blockchains. By simplifying and standardizing deployment, the User Deposit Factory plays a crucial role in delivering a seamless cross-chain experience for Zex users.

The Latin word porta means "gate" or "entrance" and as the name suggest, the ZexPorta is responsible for two critical tasks:

Monitoring Blockchain Deposits Tracking blockchain activity to extract token deposits directed to ZexCora.

Processing Withdrawal Requests Retrieving and processing withdrawal requests from the ZexCora in a secure and efficient manner.

The ZexPorta module comprises three key components:

Deposit Component

Monitors blockchain activity to identify ERC20 token transfer transactions.

Filters transactions where the recipient matches a user’s deposit address within the platform.

Acts as a data layer to store deposit transaction details.

Serves as the Signature Aggregator (SA) for PyFrost, sending deposit data to be verified.

Withdraw Component

Retrieves withdrawal requests from the Zex core and stores them in a database for processing.

Functions as the Signature Aggregator (SA) for PyFrost, coordinating signature handling.

Sends withdrawal requests to validators for data verification and issuing a signature share for execution.

Validator

Validators act as nodes within the PyFrost network.

Responsible for validating both deposit and withdrawal transactions.

Issues partial signatures, which are aggregated and verified by the Zex core and Vault contract before final approval.

Decentralization: Validators distribute the responsibility of transaction validation across multiple independent nodes, minimizing the risk of centralization.

Security: The use of threshold signatures ensures that no single Validator can compromise the system. A quorum of Validators must collaborate to approve a transaction.

Scalability: The Validator architecture can scale with the growth of the Zex ecosystem, ensuring efficient validation even as transaction volume increases.

In the upcoming sections, we provide a detailed breakdown of each component, highlighting their roles and how they contribute to the secure and decentralized operation of Zex.

To ensure a decentralized implementation, the ZexPorta module leverages the , a Python implementation of the (Flexible Round-Optimized Schnorr Threshold) protocol, to issue threshold signatures. For further information on PyFrost, please refer to the .

Traditionally, in blockchains and DEXs, funds are either held in user wallets or in liquidity pools, which are governed by smart contracts. These smart contracts are designed to ensure that only users can initiate and authorize transfers of their funds. This setup gives users full authority over their assets. Furthermore, because of the transparency inherent in blockchain technology, there is no need to verify whether a DEX holds the assets it claims to have—there is simply no room to falsify such statistics, as all transactions and balances are publicly visible and no need for submiting any proof of reserve.

In contrast, CEXs operate differently. Once users deposit their assets into a CEX, they relinquish control over those funds and essentially trust the CEX to safeguard their assets, execute trades on their behalf, and complete withdrawal requests. In other words, a CEX has complete control over the deposited funds. Moreover, due to the lack of transparency in most centralized exchanges, users cannot independently verify whether the CEX genuinely holds the assets and liquidity it claims to possess. Without proof of reserves, users have no assurance that the exchange isn’t falsifying its statistics or over-leveraging its holdings.

Furthermore, due to the transparency of the Zex system, there is no need to provide proof of reserves. Every token transfer, deposit, trade, and withdrawal is recorded in Zex logs, which are fully public and auditable. This eliminates any doubts about the platform's integrity and ensures trust through transparency.

In Zex, the platform has no control over user funds because EigenLayer nodes must validate every transaction within the platform and issue signatures for every withdrawal to be executed. As mentioned in the , the Zex AVS operates like a smart contract deployed and executed on EigenLayer nodes, secured by its restaking mechanism. So for custody, naturally, Zex is similar to DEXs, as it ensures that funds remain under the user's authority and custody and cannot be transferred without cryptographic validation by EigenLayer nodes.

Zex is composed of three core modules, each serving a critical role in its operation:

Smart Contracts

Zex utilizes three specialized smart contracts to facilitate its ecosystem:

Vault Contract: Manages and secures the assets held within the platform.

User Deposit Contract: Acts as a personal wallet for each user, enabling seamless interaction with the platform.

User Deposit Factory: Automates the deployment of individual user deposit contracts, streamlining onboarding and ensuring scalability.

ZexPorta Module The ZexPorta module continuously monitors blockchain activity, extracting and filtering token transfers relevant to the platform (i.e. user deposits to our platform). It also handles user withdrawal requests, ensuring efficient and secure processing.

ZexCora Module It consist of the Matching Engine as the heart of Zex's trading system. It maintains a comprehensive record of user orders and balances, enabling efficient and accurate order matching. This ensures a smooth trading experience comparable to centralized exchanges while preserving the benefits of decentralization.

In the subsequent sections, we delve deeper into each module, detailing the innovative architecture that makes Zex a game-changer in decentralized trading.

Zex is designed as a sufficiently decentralized exchange, powered by the on . This architecture ensures high throughput, robust security, and a permissionless trading environment that merges the advantages of centralized and decentralized exchanges.

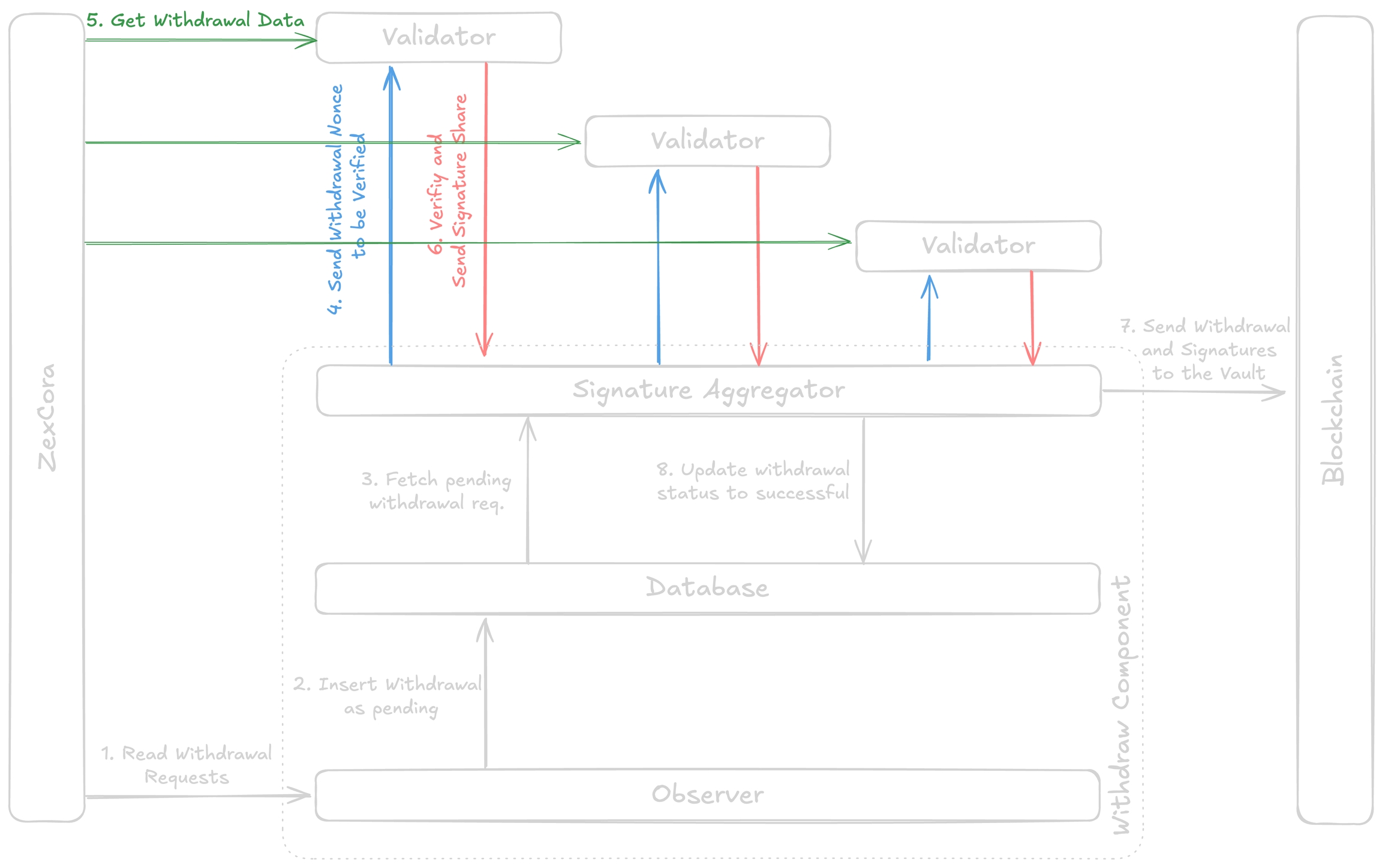

The Withdraw is a component of the ZexPorta module and responsible for ensuring that all user withdrawal requests are securely processed and finalised. It leverages the decentralized architecture to maintain transparency and integrity throughout the withdrawal process. Below is a detailed breakdown of its services and workflow:

The Withdraw Component consists of the following key services:

Database

Functionality: Tracks and updates the status of withdrawal transactions. Withdrawal requests progress through states such as pending and successful.

Technology: Uses a MongoDB database for efficient data management.

Observer

Functionality: Monitors and records withdrawal requests submitted by users via the ZexCora. Inserts new withdrawal requests into the database with a pending status for further processing.

Signature Aggregator (SA)

Functionality:

Sends pending withdrawal requests to Validators for verification.

Aggregates the signature shares issued by Validators.

Issues an ECDSA signature to enhance the security of the process.

Technology: Implements the Signature Aggregator component of the PyFrost library.

The withdrawal transaction process follows the sequence outlined in the diagram. Each step ensures that user requests are securely validated and completed efficiently.

Read Withdrawal Requests

The Observer retrieves withdrawal requests submitted by users through the ZexCora.

Insert Withdrawal Request into the Database

The Observer records the withdrawal request in the database with a pending status.

Fetch Pending Withdrawal Requests

The SA retrieves pending withdrawal requests from the database for validation and processing.

Send Withdrawal Nonce to Validators for Verification

The SA sends the nonce (i.e. a unique identifier for withdrawal on each chain) associated with the withdrawal request to Validators for verification.

Validators Retrieve Withdrawal Data

Validators independently fetch withdrawal data using withdrawal nonce from the ZexCora.

Validators Verify and Send Signature Shares

Validators validate the data of the withdrawal transaction and issue partial signatures.

These signature shares are sent back to the SA.

Send Withdrawal and Signatures to the Vault

The SA aggregates the signature shares and issues an ECDSA signature itself to enhanced security.

The aggregated data, including the signatures, is sent to the Vault interface.

Update Withdrawal Status to Successful

The SA updates the transaction status in the database to successful.

The Vault interface completes the withdrawal process by transferring tokens from the Vault to the user’s address.

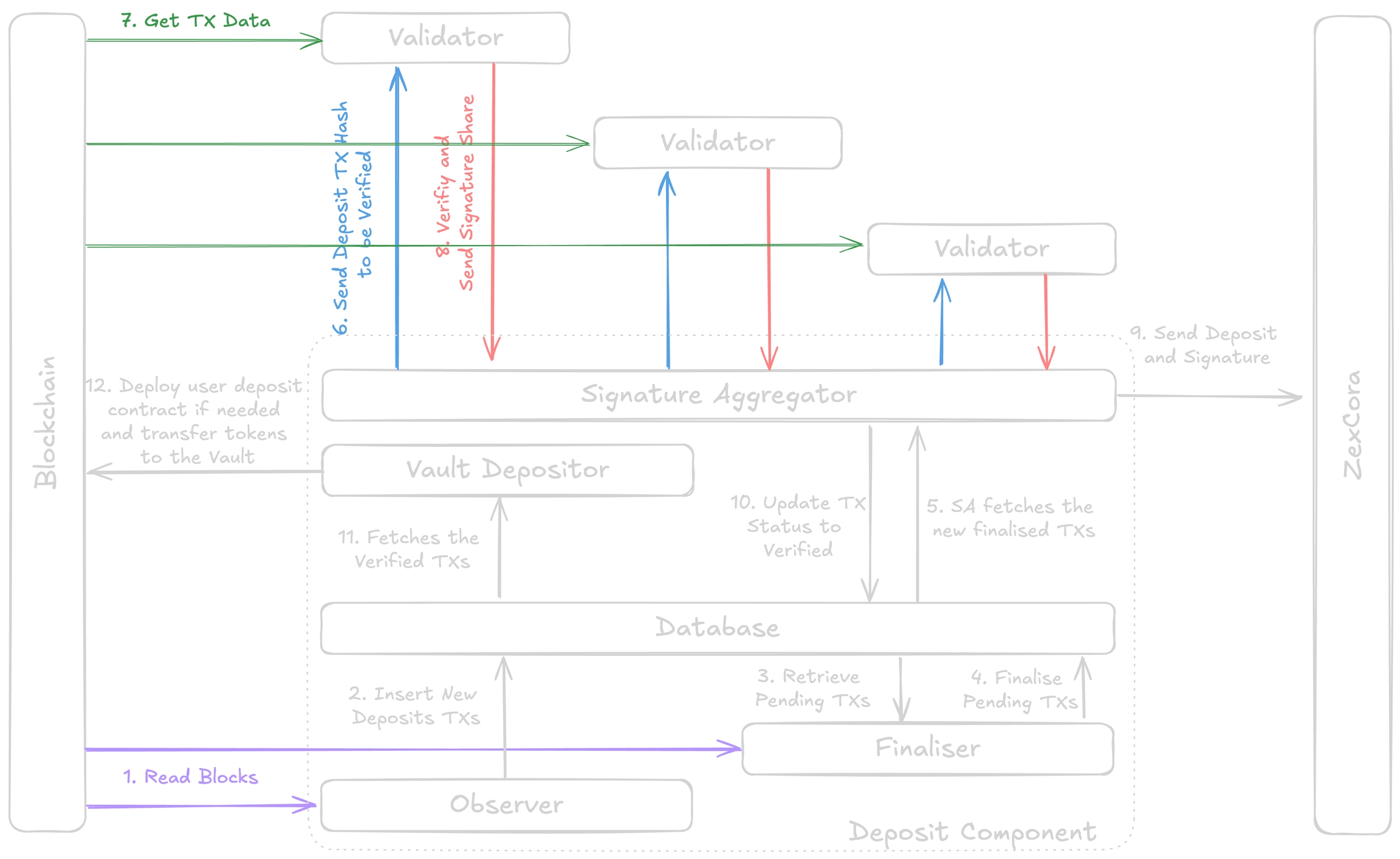

The primary goal of the Deposit Component is to ensure that all user deposits are accurately observed, processed, and passed on to the ZexCora. Below is a detailed breakdown of the deposit component services and workflow:

The Deposit Component is composed of five specialized services:

1. Database

Functionality: Manages the lifecycle of deposit transactions by maintaining their status. Transactions are tracked with one of the following states: pending, finalised, verified, successful, reorg, or rejected.

Technology: A MongoDB database is used to store and update deposit transaction records.

2. Observer

Functionality: Continuously monitors new blockchain blocks to extract ERC20 transfer transactions. Identifies and inserts transactions directed to Zex user deposit addresses into the database with a status of pending.

3. Finaliser

Functionality: Monitors finality of blocks and validates pending deposits against finalised blocks.

Reorg Handling: If a transaction is not included in a finalised block, it marks the deposit status as reorg.

4. Signature Aggregator (SA)

Functionality: Sends finalised deposit transactions to Validators for verification. Then aggregates the signature shares issued by Validators. Furthermore, issues an additional ECDSA signature for further security.

Technology: Implements the Signature Aggregator component of the PyFrost library.

5. Vault Depositor

Task: Processes verified deposit transactions to transfer funds to the Vault.

Additional Functionality: Deploys user deposit contracts through the factory if they are not already deployed, ensuring seamless fund transfers.

The deposit transaction process follows the flow illustrated in the diagram above. Each step ensures that user deposits are securely processed and efficiently transferred to the Zex Vault. Below is a detailed explanation of each step:

Observer Reads Blockchain Blocks

The Observer continuously monitors blockchain activity, extracting ERC20 token transfer transactions from each block.

Insert New Deposit Transactions into the Database

The Observer identifies transfers where the recipient matches a Zex user’s deposit address.

These transactions are marked as deposits and inserted into the database with a pending status.

Retrieve Pending Transactions

The Finaliser retrieves pending deposits from the database for further validation.

Finalise Pending Transactions

The Finaliser checks if pending transactions are included in a finalised block.

If the transaction is included, its status is updated to finalised.

If not, the transaction is marked as a reorg.

SA Fetches New Finalised Transactions

The Signature Aggregator (SA) retrieves finalised transactions from the database to initiate the signature process.

Send Deposit Transaction Hash to Validators for Verification

The SA sends the hash of finalised transactions to Validators for validation.

Validators Retrieve Transaction Data

Validators independently fetch transaction data from the blockchain and verify the finality of the block containing the transaction.

Validators Verify and Send Signature Shares

Validators validate the deposit transaction and issue partial signatures, which are sent back to the SA.

Send Deposit and Signatures to ZexCora

The SA aggregates the signature shares from Validators and creates an additional ECDSA signature for security.

The finalised deposit data, along with the aggregated signatures, is sent to the ZexCora.

ZexCora verifies the data and updates the user’s balance.

Update Transaction Status to Verified

The SA updates the deposit transaction status in the database to verified.

Vault Depositor Fetches Verified Transactions

The Vault Depositor retrieves verified transactions from the database for further processing.

Transfer Funds to the Vault

The Vault Depositor transfers the deposited tokens to the Zex Vault.

If the user’s deposit contract is not yet deployed, the Vault Depositor deploys the contract using the factory before completing the transfer.

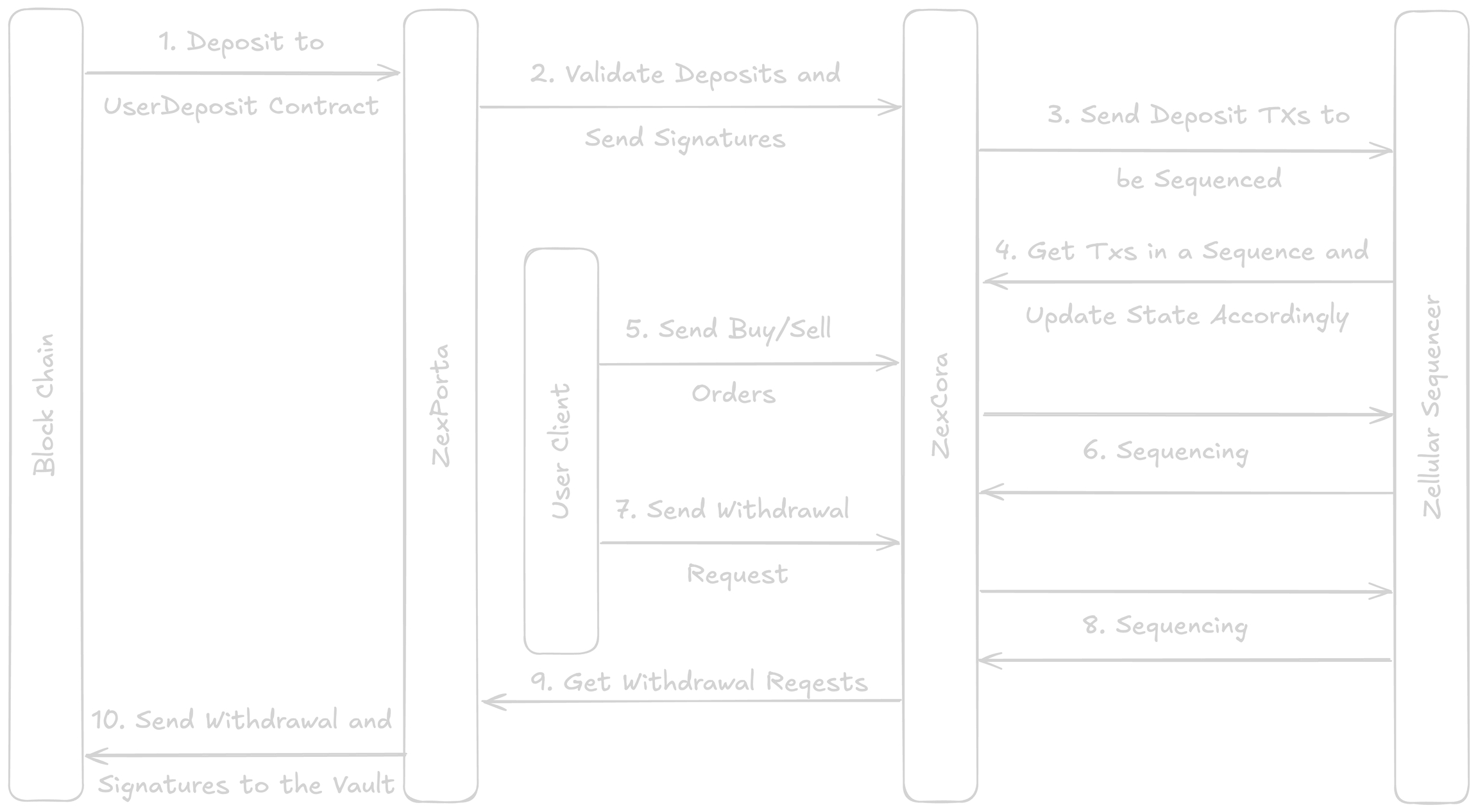

The on-chain interactions of any off-chain exchange occur usually when users initiate deposit or withdrawal requests. In Zex, all such interactions are managed through the ZexPorta module.

As mentioned earlier, ZexPorta constantly monitors blockchain transactions and filters out transfers that correspond to deposits made to our platform. Once a deposit is identified, ZexPorta requests its validators to confirm the deposit and generate a threshold signature using the FROST algorithm. After the individual signature shares are aggregated, the deposit data, along with the aggregated signature, is sent to ZexCora for sequencing and execution.

When a user initiates a withdrawal request in ZexCora, the request is first processed off-chain. ZexPorta observes this new withdrawal request registered and finalised in ZexCora. After preprocessing steps (which may vary depending on the specific blockchain), ZexPorta requests the ZexCora nodes on EigenLayer to issue a threshold signature for the withdrawal. Once the signature shares are aggregated, ZexPorta broadcasts the withdrawal transaction on-chain, completing the transfer from the platform to the user’s wallet, along with the verified signature.

Validators are pivotal in maintaining the security, integrity, and decentralization of the ZexPorta module. They function as decentralized PyFrost Nodes, tasked with validating both deposit and withdrawal transactions. Validators ensure that all data corresponding to these operations meet stringent standards and pass accurately to the ZexCora and the Vault contract.

Validators are integral to the decentralized design of ZexPorta module, ensuring that no single entity has control over the transaction approval process. By distributing responsibility across multiple Validators, Zex achieves a high level of security and decentralization.

Threshold Signature Protocol

This protocol ensures that no single Validator can unilaterally sign a transaction, requiring collaboration among a quorum of Validators to generate a valid signature.

Signature Aggregation

Validators issue partial signatures for both deposit and withdrawal transactions.

These partial signatures are aggregated by the SA to produce a complete, secure signature, which is then forwarded to the ZexCora or to the Vault contract for final processing.

Validators in the ZexPorta module are designed to handle tasks associated with both deposit and withdrawal processes:

1. Deposit Validation

Validators retrieve finalised deposit transactions from the blockchain using the hash provided by the SA.

They verify the finality of the block containing the transaction.

Upon successful verification, Validators generate partial signatures for the deposit transaction data and send them to the Signature Aggregator (SA).

2. Withdrawal Validation

Validators fetch withdrawal requests from the ZexCora by the corresponding transaction nonce provided by SA. Then the Validators generate partial signatures for the withdrawal request and send them back to the SA.

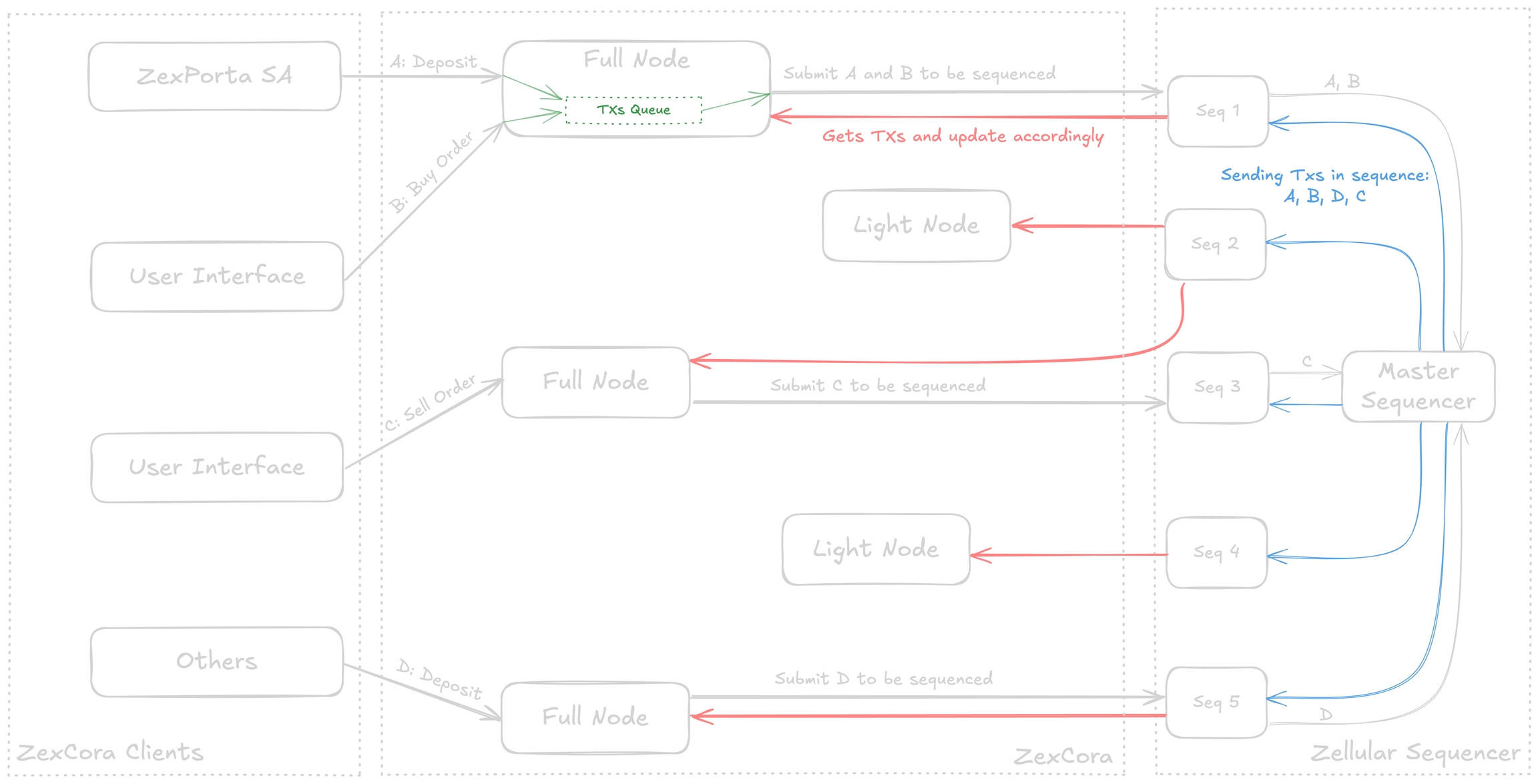

Derived from the Latin word cora, meaning "heart" or "core," ZexCora serves as the central hub of our platform. It is responsible for fundamental exchange functionalities, such as the matching engine and maintaining user balances and states.

To optimize system performance and accessibility, ZexCora operates with two types of nodes:

Light Node: Light nodes are responsible for maintaining the system state and tracking transactions that alter the state. Anyone can read the state from any light node.

Full Node: Full nodes, in addition to maintaining records, can process external requests and transactions. Running a full node requires more resources than a light node due to the additional responsibilities.

The ZexCora platform employs a robust system to process transactions efficiently and securely. Below is a step-by-step explanation of how the architecture handles transactions:

Transaction Submission Transactions are initiated by ZexPorta SA, user interfaces (UI), or other external sources acting as ZexCora clients. These transactions, such as deposits, buy orders, and sell orders, are sent to ZexCora Full Nodes.

Processing by Full Nodes The Full Nodes receive the transactions, place them in a transaction queue. Full Nodes then prepare the transactions to be forwarded to the Sequencer for ordering.

Forwarding to Sequencer Nodes Full Nodes send the transactions to one of the Sequencer Nodes in the Zellular Sequencer. These Sequencer Nodes collect transactions for ordering and send them to the Master Sequencer.

Global Ordering by Master Sequencer The Master Sequencer collects transactions from all Sequencer Nodes and organizes them into a single, definitive sequence. For example, if transactions A, B, C, and D are received, the Master Sequencer may arrange them as A, B, D, C. The ordered sequence is then broadcast to all nodes within the Zellular Sequencer.

Verification by Light Nodes ZexCora Light Nodes receive the sequenced transactions and verify their integrity and validity. Light Nodes ensure the transactions are consistent with the current system state.

Validation by Full Nodes Verified transactions are collected by Full Nodes for detailed validation. Each transaction is checked for source authenticity and applicability to the current system state. For example, in a withdrawal transaction, the system checks if the user has sufficient funds available.

Transaction Execution Once validated, the transactions are forwarded to the Matching Engine and executed:

For deposits and withdrawals, the user’s balance is updated.

For buy and sell orders, based on the order price, the transactions are registered in an order book or executed instantly.

This step-by-step architecture ensures secure, transparent, and efficient transaction processing within the ZexCora platform.

The following tables outline the data format for all transaction types.

version

Request version; 1 in this instance

1 byte

name

rfor REGISTER

1 byte

public

Public key of the sender

33 bytes

sig

Signature from the sender

64 bytes

Total Length

Depends on the length of the message.

99 bytes

The sender should sign the follwing massege:

version

Request version; 1 in this instance

1 byte

name

bfor BUY or sfor SELL

1 byte

base_token_len

Lenght of Base token identifier

1 byte

quote_token_len

Lenght of Base Quote token identifier

1 byte

base_token

Base token identifier

Variable

quote_token

Quote token identifier

Variable

amount

Order amount

8 bytes

price

Price per unit

8 bytes

t

Timestamp

4 bytes

nonce

Unique transaction identifier

4 bytes

public

Public key of the sender

33 bytes

sig

Signature from the sender

64 bytes

Total Length

Total length depends on base_token and quote_token length.

Variable

The sender should sign the follwing massege:

version

Request version; 1 in this instance

1 byte

name

cfor CANCEL

1 byte

order_tx

Variable

public

Public key of the sender

33 bytes

sig

Signature from the sender

64 bytes

Total Length

Minimum length is 99 bytes (header + slice + public key).

Variable

The sender should sign the follwing massege:

version

Request version; 1 in this instance

1 byte

name

dfro DEPOSIT

1 byte

token_chain

Chain identifier for the token

3 bytes

deposit_count

Number of deposits included in the current transaction

2 bytes

Decoded Message

Per Deposit

Variable

tx_hash

Deposit transaction hash

66 bytes

token

The address of deposited token

42 bytes

value

Deposit amount

32 bytes

decimals

The decimals of deposited token

1 byte

block_timestamp

Time of deposit

4 bytes

user_id

User identifier

8 bytes

internal_tx_number

Number of internal transation (in case deposit occurs in a transaction with multiple intenal transaction) or the output number (e.g. for Bitcoin)

1 byte

For the Whole Batch Deposit Request

frost_sig

FROST group signature

32 bytes

ecdsa_sig

ECDSA signature

132 bytes

Total Length

Total length is calculated based on the deposit-specific message size.

Variable

The sender should sign the encoded message that is described above.

version

Request version; 1 in this instance

1 byte

name

wfro WITHDRAWAL

1 byte

token_len

Lenght of the Token identifier

1 byte

token_chain

Chain identifier for the token

3 bytes

token_name

Token identifier

Variable

amount

Amount to withdraw

8 bytes

destination

Destination address

20 bytes

t

Timestamp

4 bytes

nonce

Unique transaction identifier

4 bytes

public

Public key of the sender

33 bytes

sig

Signature from the sender

64 bytes

Total Length

Total length depends on token_name length.

Variable

The sender should sign the follwing massege:

Note: Zex has no authority to transfer funds from the vault without the confirmation of EigenLayer nodes. We'll expain this in the .

Validators implement the protocol via the .